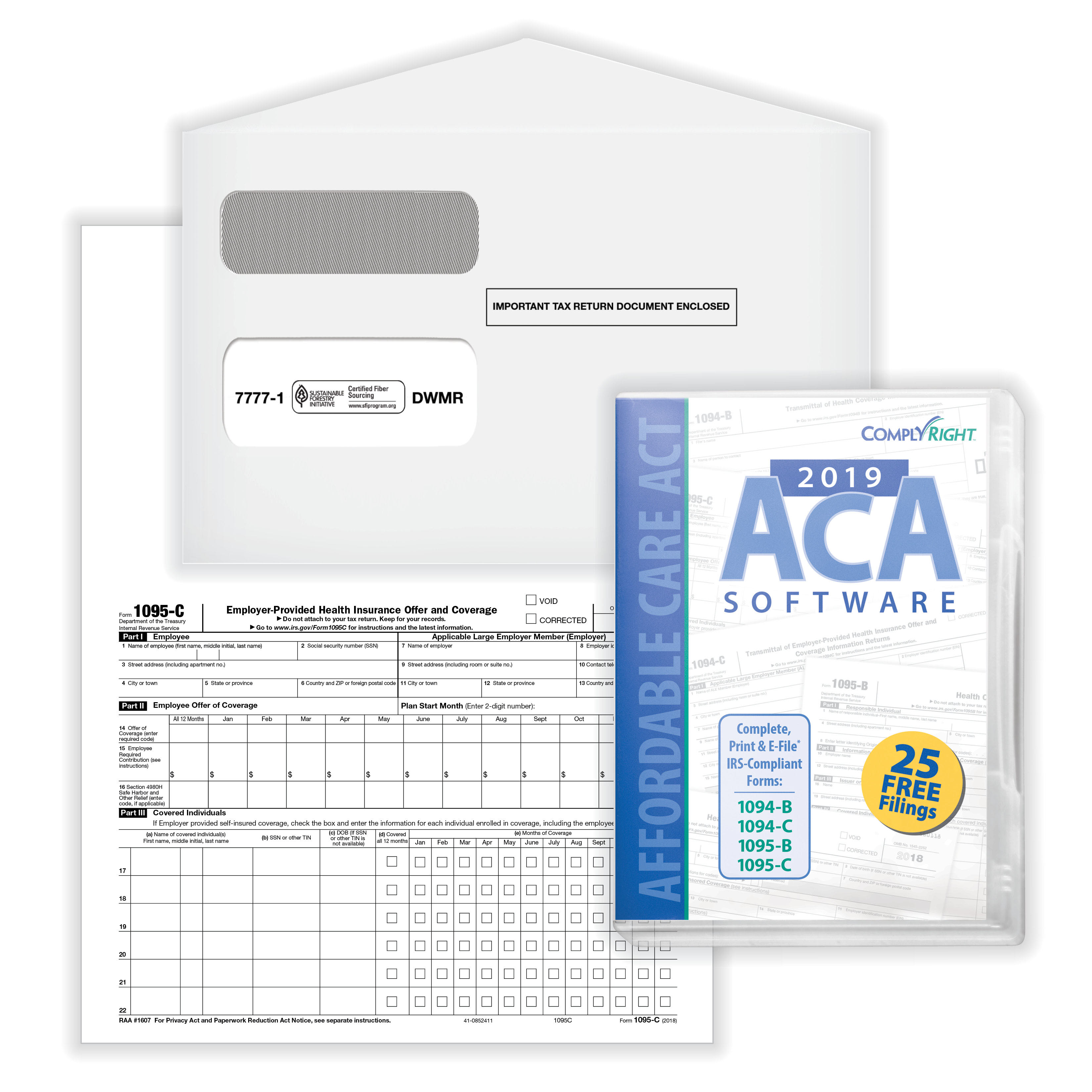

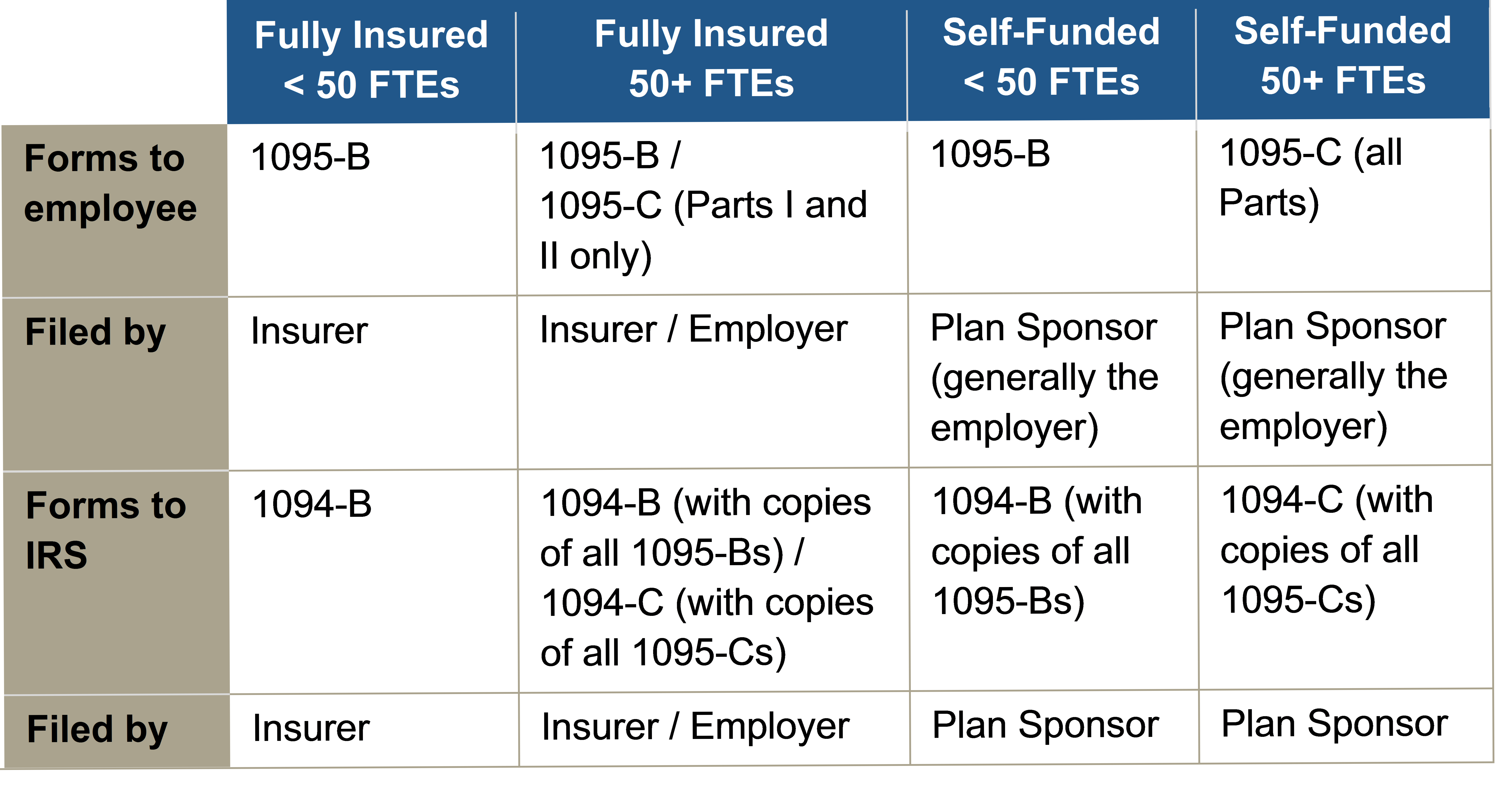

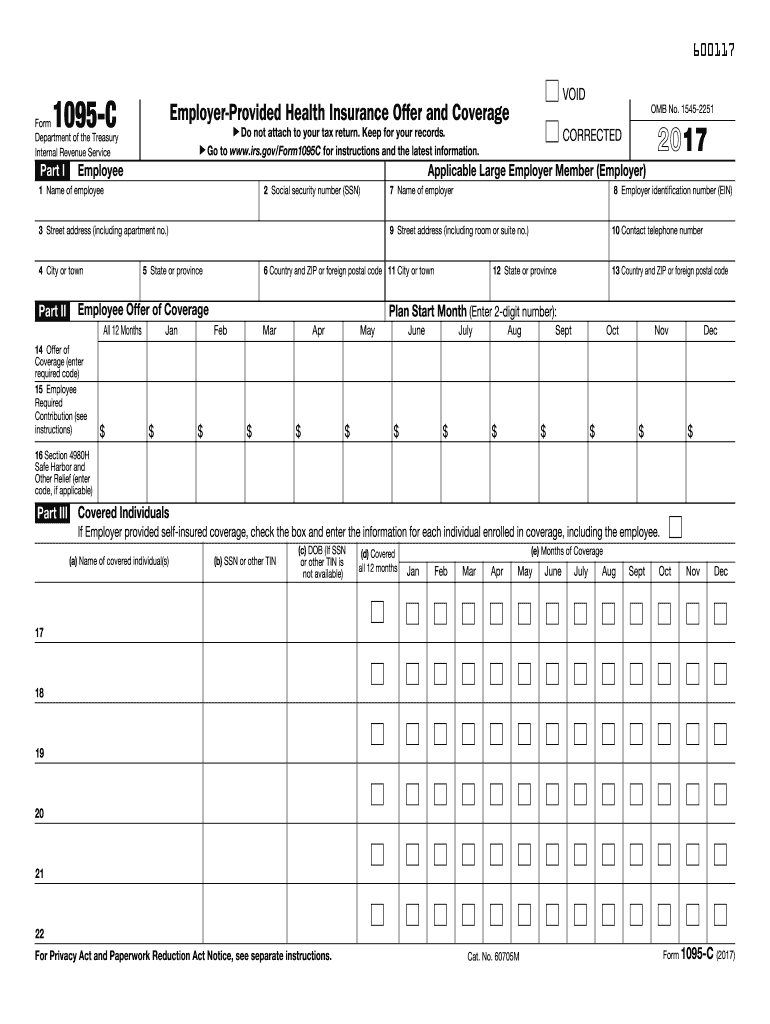

Section 1 Preparing for 18 ACA Reporting This Training Includes (click links to jump to specific sections) NOTE Screen shots contained herein are subject to change (1) Preparing for 18 ACA Reporting, (2) Compiling your 1095C Information, (3) Furnishing 1095C's to Employees, (4) Creating your 1094C, (5) Paper Filing your Information Return, (6) Electronically Filing your1095c instructions 1921 Complete forms electronically working with PDF or Word format Make them reusable by generating templates, include and fill out fillable fields Approve forms with a lawful electronic signature and share them through email, fax or print them out Save blanks on your computer or mobile device Enhance your efficiency with powerful solution? IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the

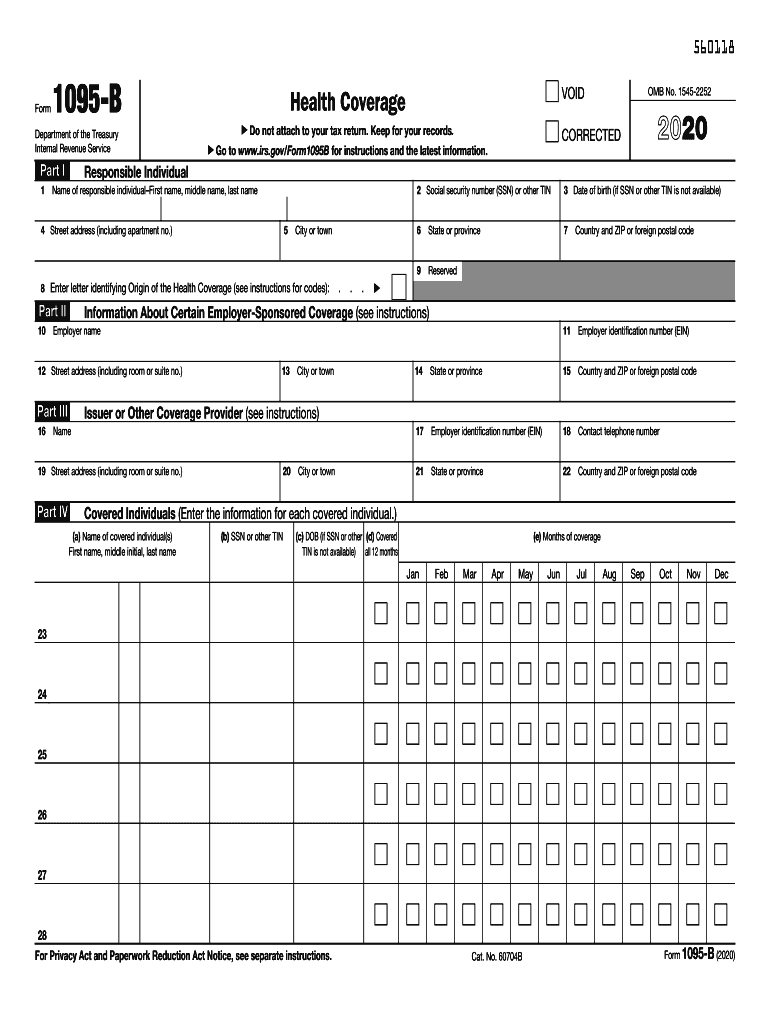

Form 1095 A 1095 B 1095 C And Instructions

Irs form 1094 c instructions 2018

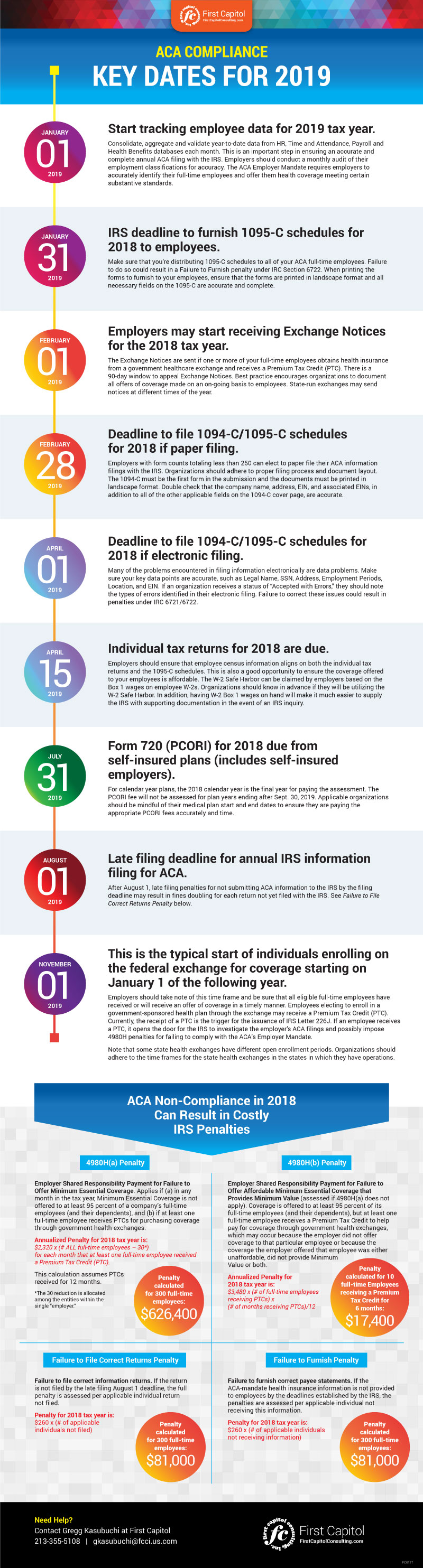

Irs form 1094 c instructions 2018- The IRS released draft instructions for the 17 Form 1094 and 1095 B and C Forms for reporting under the Affordable Care Act Form 1095B/C is required to be furnished to individuals by Form 1094B/C is required to be transmitted to the Internal Revenue Service by (if furnishing on paper) and by March 31 18 Instructions for Forms 1094C and 1095C 18 Instructions for Forms 1094B and 1095B Ensure a successful 18 reporting season With the IRS assessing potentially costly penalties to companies that may be out of compliance, accurate completion of these forms has never been more important If you are already working with Health e(fx

Q Tbn And9gcrkv0eivjd2lvnvsnjzd0hwmco6gove1hitfp7wdnojwps1lvpe Usqp Cau

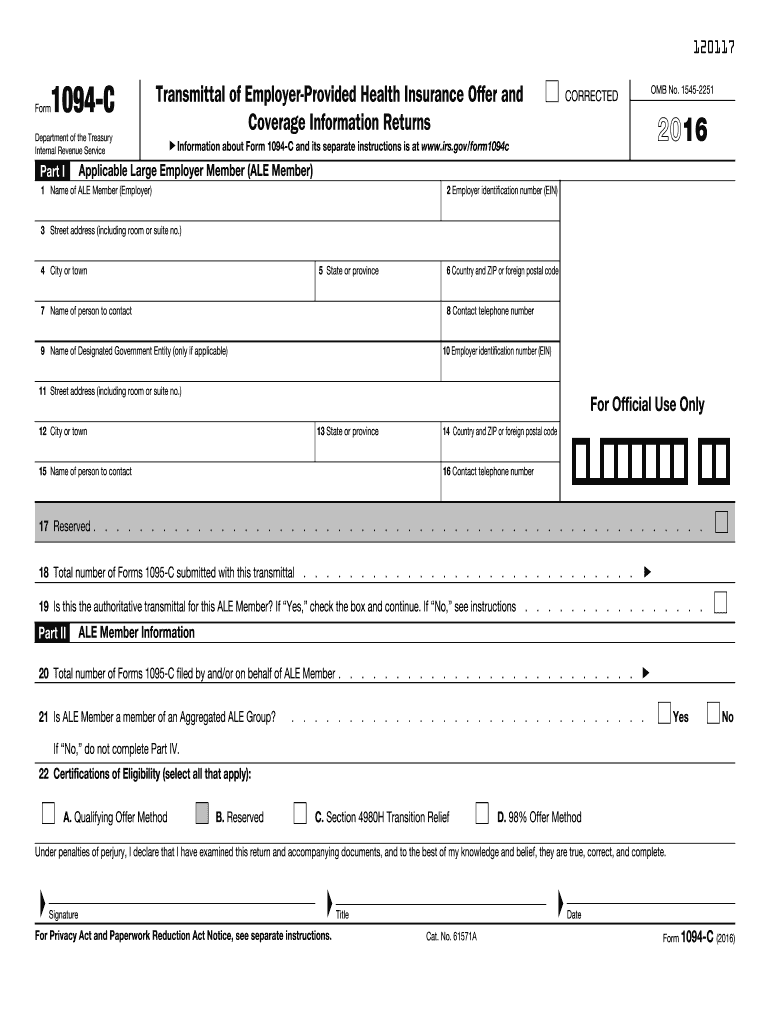

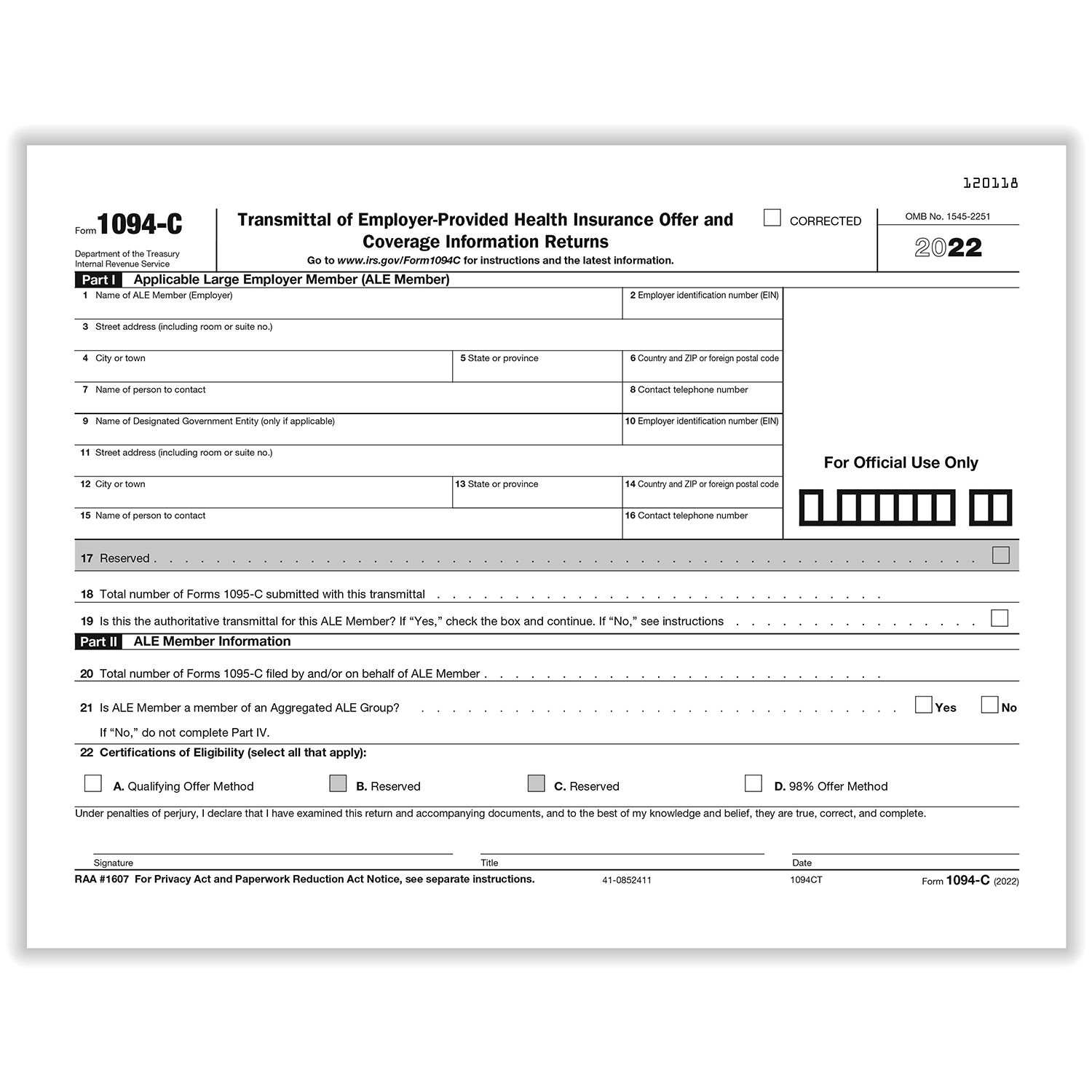

18 form 1094 c irs form 1094 c 18 page 2 part iii ale member information—monthly a minimum essential coverage fer indicator yes no b section 4980h full time purpose of form internal revenue service instructions for forms 1094 c and 1095 c department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted futureStep 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines

18 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance Instructions The deadlines to furnish statements to individuals and to file with the IRS have been updated from 17 to 18 Consistent with the changes to Form 1094C, references to the Section 4980H transition relief have been removed The instructions address several minor issues affecting Form 1095C C Form Instructions The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage

The way to complete the 1094 c 18 form online To start the blank, use the Fill & Sign Online button or tick the preview image of the form The advanced tools of the editor will guide you through the editable PDF template Enter your official contact and identification detailsResponding to IRS Letter 226J Contact Info Final Instructions for the Forms 1094C and 1095C Released with Few Changes – However IRS Enforcing the Employer Mandate Changes Everything The IRS recently released the final instructions to the Forms 1094C and 1095C with minimal changes compared to the final instructions from 17 Most of the changes made compared to previous

2

Www Irs Gov Pub Irs Prior F09 18 Pdf

The 1094C form allows employers to report that by allowing spaces to report on a monthbymonth basis as shown below 179 180 After you report whether you offered at least minimum essential coverage or not, the IRS wants to know how many full time employees the reporting ALEM had on a monthtomonth basis 180Generally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 18, Forms 1094C and 1095C are required to be filed by , or , if filing electronicallyPart II – ALE Member Information Line 22 A Qualifying Offer Method C Section 4980 transition Relief D 98% Offer Method

Form 1094 C The Aca Times

2

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us CreatorsOctober 18 The Internal Revenue Service ("IRS") has released the final 18 version of the Affordable are Act ("AA") Information Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formattingForm 1094c instructions 18 Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form 1095C, steer clear of blunders along with furnish it in a timely manner

Deadlines For Tax Year 17 Public Documents 1099 Pro Wiki

2

IRS Releases Final 1094C and 1095C Forms and Instructions On , the Internal Revenue Service (IRS) released the final Forms 1094C and 1095C that are required to comply with section 6055 and 6056 of the Affordable Care Act (ACA) Employers that are subject to the employer shared responsibility provisions under section 4980HMailing Instructions for Filing Paper Forms 1094C and 1095c Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Do not paperclip or staple the forms together Check for the correct IRS address Postal regulations require all forms and packages to be sent by FirstClass MailThere is a detailed instruction on how to fill up the form on the CAT website Both written and a video format The instructions are easy to

Admin Abcsignup Com Files 7b0f 03da 4619 Add5 95b8fc087aa3 7d 6 Adpproconference Acapreparenowforaseamless18filing Pdf

Instructions For Forms 1095 C Taxbandits Youtube

In early August the draft instructions were released for the Forms 1094C and 1095C for 16 While not much has changed, there are some differences in the Forms compared to 15 and the IRS emphasized certain areas we assume many filers struggled with in 15 This article is intended to provide an overview of the changes, provide helpful reminders, and point 18 Form 1094C/1095C Instructions – Penalties for reporting failures and errors will increase to $270 per violation up to an annual maximum of $3,275,500 Please note Penalty limits apply separately to IRS information returns and individual statements 1094C/1095C Deadlines Form 1095C must be sent out to employees byFor calendar year 17, Forms 1094C and 1095C are required to be filed by , or , if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information Returns

Img1 Wsimg Com Blobby Go 6794fc4e 99 44b2 69 Bcaf3 Downloads 18 codes for irs form 1095 C Part ii E2 80 8b Pdf Ver

Datatechag Com Ag Web Docs How To file aca information returns Pdf

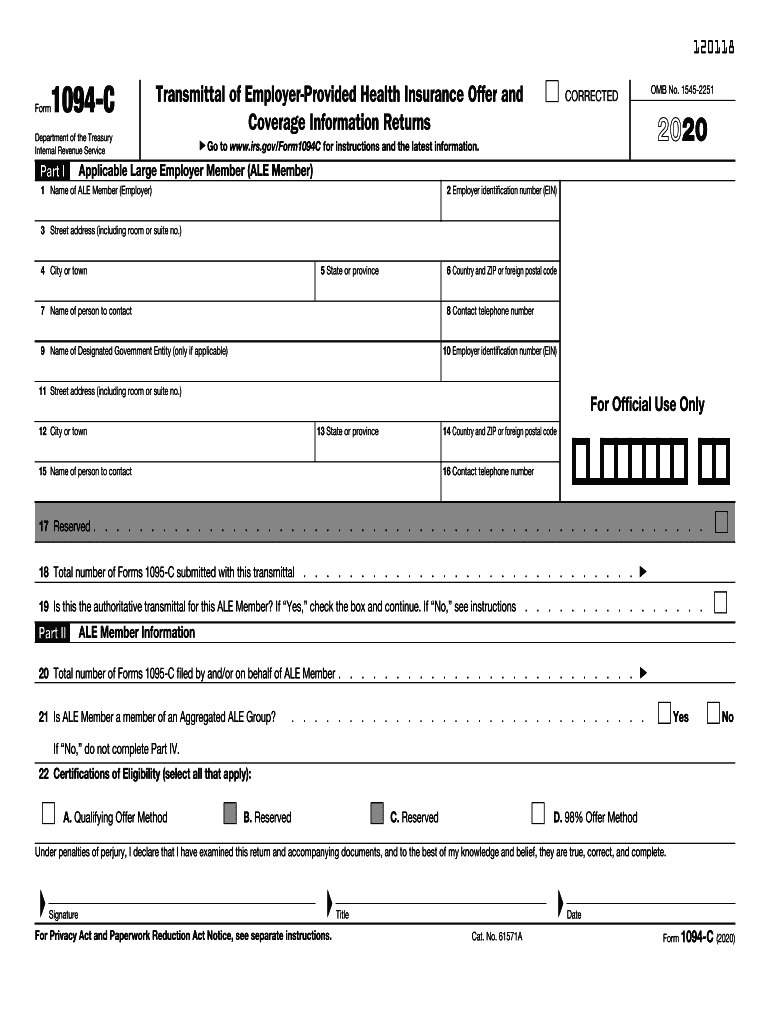

18 Forms 1094C and 1095C (and related instructions) are used by applicable large employers (ALEs) to report under Section 6056, as well as for combined Section 6055 and 6056 reporting by ALEs who sponsor selfinsured plans The 18 forms and instructions are substantially similar to the 17 versions Action StepsHow to complete any Form 1094C online On the site with all the document, click on Begin immediately along with complete for the editor Use your indications to submit established track record areas Add your own info and speak to data Make sure that you enter correct details and numbers throughout suitable areas1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 18 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

Www Chernoffdiamond Com Wp Content Uploads 18 10 Cdco Client Alert Irs Releases Final 18 Aca Forms Instructions 1094c 1095c October 18 Pdf

Datatechag Com Ag Web Docs How To file aca information returns Pdf

Contact support How do I fill out the CAT 18 application form?However, it is still possible that changes will occur HR managers will usually accept forms from the previous year There are, however, some 1094C and 1095C form changes that need to be understood Verbiage Change to the Form Instructions Forms 1094C and 1095C have both experienced verbiage changes Updated For Administrators and Employees Here's how to determine which IRS address to use when filing ACA forms by mail For more information about IRS mailing addresses, see the IRS Instructions for Forms 1094C and 1095C page

2

Prepare For Early 18 Aca Information Reporting On Health Coverage

The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link The new 18 version of Form 1094C and Form 1095C are available at these links 18 Form 1094C 18 Form 1095C The IRS has also issued the filing schedule for ACA reporting for theRobert Sheen 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the Read More IRS Letter 226J Penalty Notices for 16 May Contain Higher Penalties From the 19 Instructions for Forms 1094C and 1095C Purpose of Form Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their

1095 Tax Form 17 New Form Tax11irs F1042 Page 1 Fascinating 1042 Templates Models Form Ideas

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

18 Forms and Instructions Instructions for both the 1094B and 1095B and the 1094C and 1095C were released, as were the forms for 1094B, 1095B, 1094C, and 1095C There are no substantive changes in the forms or instructions between 17 and 18, beyond the further removal of nowexpired forms of transition reliefForm 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updatedFor 18 reporting (forms are due in early 19) 18 Form 1094C, EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Instructions for 18 Forms 1094C

Irs Forms Publications Lattaharris Llp

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsSimilar to the 1094C and 1095C corrections, the 16 Instructions for Forms 1094B and 1095B contain discussions on correction methods and Section 71 of Publication 5165 is the source for instructions for making a correction to a Form 1095B filed electronically This article provides stepbystep instructions for printing and mailing ACA forms to EMPLOYEES through the Greenshades integration Please note this is an optional service and additional costs may apply Follow the wizard to complete the 1095C/1094C filing Greenshades YearEnd Video Help

1095 B And C Form Pack Of 100 Amazon In Office Products

2

The IRS has released draft ACA Reporting Forms and Instructions for 18 (to be filed in 19) Background The Affordable Care Act ("ACA") requires employers and providers of health insurance coverage to report certain information to the IRS and plan participants each year The 18 final forms and instructions appear to have only minor changes compared to the 17 forms Highlights of the changes are as follows 1094B – Appears unchanged 1094C – Appears unchanged 1095B – Appears unchangedExample 1 Employer A, an ALE Member, files a single Form 1094C, attaching Forms 1095C for each of its 100 fulltime employees This Form 1094C should be identified as the Authoritative Transmittal on line 19, and the remainder of the form completed as indicated in the instructions for line 19, later Example 2

Datatechag Com Ag Web Docs How To file aca information returns Pdf

2

1094c instructions >> DOWNLOAD 1094c instructions >> READ ONLINE Back to 1094C Form Guide ;18 instructions form 1094c 17 1094c 1095c part iii How to create an eSignature for the 1094 c 17 pdf Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures For more information, see the instructions for Form 1094C, Part III, column (a) 2I Reserved Latest Press Will ACA be around next year?

New Form 1095 B 17 Models Form Ideas

1095 C 15 Pdf

The IRS released the final drafts of the Forms 1094C, 1095C, 1094B and 1095B, as well as Instructions for the Cforms and BformsThese final editions reflect the previously issued drafts for the ACA 18 calendar year reporting18 Form 1095C Instructions Form 1095C (18) Instructions for Recipient You are receiving this Form because your employer is an Applicable Large Employer subject to the employer shared resgnnsibility prwision n the Affordable Care Act This Form ID95—C ncludesMailing instructions for filing paper forms 1094c and 1095c Aca reporting forms 1095a, 1095b, 1094c, 1095c Irs releases draft 18 forms 1094 and 1095 and related

Blog Irs 1094

2

This section contains the definitions of key terms used in Forms 1094C and 1095C and these instructions For definitions of terms not included in this section, see the final regulations under section 4980H, TD 9655, 149 IRB 541, and section 6056, TD 9661, 1413 IRB 8551094 C 18 Form FAQs Hit on answers to listed questions about 1094 C 18 Form Discover the most ordinary topics and more Need help? 18 Instructions for Forms 1094C and 1095C (instructions) Employers that selffund a minimum essential coverage plan are required to report coverage information about enrollees To meet this reporting requirement, employers will use the following 18 Form 1094B (transmittal to IRS) 18 Form 1095B (statement to individual) 18

2

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Instructions For Forms 1095 C Taxbandits Youtube

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Prepare For Early 18 Aca Information Reporting On Health Coverage

Admin Abcsignup Com Files 7b0f 03da 4619 Add5 95b8fc087aa3 7d 6 Adpproconference Acapreparenowforaseamless18filing Pdf

1

2

2

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

2

2

Mark These 19 Dates For 18 Aca Reporting Update The Aca Times

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

Form 1095 A 1095 B 1095 C And Instructions

Datatechag Com Ag Web Docs How To file aca information returns Pdf

Form 1095 C H R Block

2

Www Gadoe Org Technology Services Pcgenesis Documents Aca Test File Submission Pdf

Irs 1094 B 21 Fill Out Tax Template Online Us Legal Forms

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

2

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

Blog Irs Reporting

Www Irs Gov Pub Irs Prior Ib 18 Pdf

Tax Forms Office Depot Officemax

Www Tax Ny Gov Pdf Pit Irs Docs 18 schedule a instructions Pdf

Form 1094 C The Aca Times

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

Q Tbn And9gcrkv0eivjd2lvnvsnjzd0hwmco6gove1hitfp7wdnojwps1lvpe Usqp Cau

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

United Benefit Advisors Home News Article

Nj Health Insurance Mandate Information For Employers

Form 1095 A 1095 B 1095 C And Instructions

2

2

16 Instructions For 1040 C Irs

Http Www Psfinc Com Hcr Files Agwebinarseries 10 26 17 Pdf

News Semple Solutions Llc Insurance Solutions In New Jerseysemple Solutions Llc Insurance Solutions In New Jersey

Form 1099 Nec Requirements Deadlines And Penalties Efile360

2

Www Opm Gov Retirement Services Publications Forms Benefits Administration Letters 17 17 1 Pdf

2

Irs Releases Final 18 Aca Reporting Forms And Instructions Blog Mma

March 31 Is The Deadline For E Filing Aca Returns With The Irs The Aca Times

Vehi Org Client Media Files 02 Irs Reporting Webinar Vehi Resource Guide Overview 9 25 18 2a12 3 18 Pdf

Www Stephens Com Globalassets Insurance Webinars What Employers Need To Know About Irs Reporting In 19 Pdf

2

Www Lawleyinsurance Com Wp Content Uploads 18 11 1095 C Final 18 Forms Pdf

2

2

Irs Announces New Deadline For Providing 1095 Cs To Employees

Irs 1094 C 16 Fill Out Tax Template Online Us Legal Forms

Www Hartford Edu About Offices Divisions Finance Administration Information Technology Services Banner Files Hrpay Banner Human Resources Yearend Regulatory Handbook Us Puertorico 8 15 1 9 3 9 Dec 18 Pdf

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Www Selectebs Com S Irs Releases Draft 19 Aca Reporting Forms And Instructions Print 11 15 19 Pdf

2

Q Tbn And9gcqfkwn5kldls95udr6fjjdp6i8lwd6lrj1nrznfn Mfozhc C Usqp Cau

Www Irs Gov Pub Irs Utl Instructions for ty18 criteria Based aats scenarios Pdf

Instructions For Forms 1095 C Taxbandits Youtube

ins Net S Mbwl Employers Guide To Aca Reporting 10 08 18 ins Pdf

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

2

Personnel Forms Office Products Pack Of 100 18 Complyright 1095 C Irs Employer Provided Health Insurance Form

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

Irs Eliminates Automatic 1099 Misc W 2 Extensions For 18 Wage Filing

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

2

Updated Irs Reporting Requirements Babb Insurance

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Extends Due Date For Employers To Issue Health Coverage Forms In 18 News Illinois State

Affordable Care Act Form Software Supplies Shops

2

Www Hayscompanies Com Wp Content Uploads 18 10 Here Come The 1095s Pdf

Form W2c Instructions 17 Awesome Tax Forms At Fice Depot Ficemax Models Form Ideas

2

No comments:

Post a Comment